ETH Price Prediction: Path to $10,000 Amid Institutional Surge

#ETH

- Technical Breakout Potential - ETH trading above key moving averages with Bollinger Band compression suggesting imminent volatility expansion

- Institutional Momentum - $11B+ ETF inflows and major investment from financial giants creating sustained buying pressure

- Fundamental Developments - Ethereum's 2025 privacy roadmap and network upgrades providing long-term value foundation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

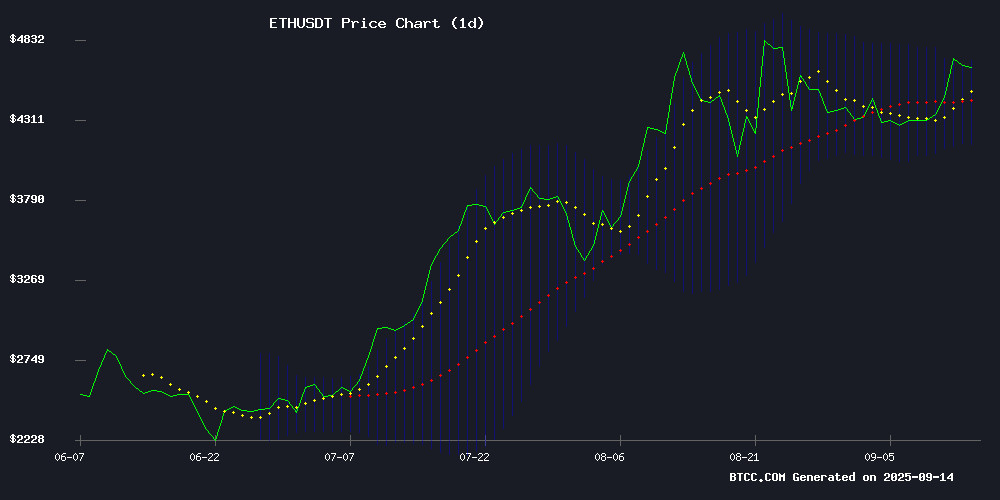

ETH is currently trading at $4,620.90, comfortably above its 20-day moving average of $4,422.21, indicating sustained bullish momentum. The MACD reading of 49.34 versus its signal line at 89.16 suggests some near-term consolidation, though the price remains within the upper Bollinger Band range of $4,688.99. According to BTCC financial analyst Olivia, 'The technical setup supports further upside potential, with key resistance at the $4,689 level representing the immediate target.'

Market Sentiment: Institutional Inflows and ETF Momentum Drive Optimism

Positive news flow surrounding ethereum continues to build, with BlackRock and Fidelity's $333 million investment highlighting strong institutional confidence. ETF inflows surpassing $11 billion create substantial underlying demand pressure. BTCC financial analyst Olivia notes, 'The combination of institutional adoption and technical breakout patterns suggests the $5,200-$6,800 target range remains achievable by year-end, though traders should monitor volatility compression for potential breakout signals.'

Factors Influencing ETH's Price

Ethereum Founder Vitalik Buterin Criticizes AI Governance as Fundamentally Flawed

Vitalik Buterin, co-founder of Ethereum, has publicly denounced the use of artificial intelligence in governance systems, labeling it a "bad idea." His comments came in response to revelations about vulnerabilities in ChatGPT's newly implemented Model Context Protocol (MCP) tools, which enable the AI to interface with external applications like Gmail and Notion.

Buterin's warning centers on the inherent risks of AI manipulation. "If you use an AI to allocate funding for contributions, people WILL put a jailbreak plus 'gimme all the money' in as many places as they can," he stated. This critique follows Eito Miyamura's demonstration of how ChatGPT's MCP integration creates a three-step exploit pathway, where attackers can exfiltrate private data through malicious calendar invites containing jailbreak prompts.

The security flaw requires no victim interaction—merely receiving the compromised invite enables data leakage. This vulnerability underscores Buterin's broader skepticism about AI's role in decision-making systems, particularly in cryptocurrency ecosystems where governance models are increasingly automated.

Ethereum Volatility Narrows, Signaling Potential Breakout or Correction

Ethereum's price has been consolidating between $4,300 and $4,500, with Bollinger Bands indicating historically low volatility—a classic precursor to major price movements. Analysts are divided between anticipating a rally toward new highs or a pullback to $3,500.

"Expect a big move," warns trader Ali Martinez, echoing John Bollinger's framework that tight bands often precede explosive breakouts. Market sentiment mirrors Bitcoin’s 2020-2021 bull cycle, fueling speculation of an impending surge.

The silence before the storm: ETH’s sideways trading belies mounting tension among traders. Technicals suggest the squeeze will resolve violently, but direction remains contested—a binary bet on crypto’s second-largest asset.

Ethereum (ETH) Price Targets $10,000 As ETFs Pull Inflows Past $11B

Ethereum traded around $4,665, marking a 9.42% weekly gain despite a 1.20% daily dip. Institutional demand surged as spot ETFs absorbed over $11 billion in inflows, fueling speculation of a $10,000 price target within the year.

Market analysts highlight structural shifts from previous cycles. "Investors dismissed ETH at $1,500, doubted it at $2,200, and ignored it at $4,000," noted trader Merlijn, underscoring Wall Street's growing participation through ETF channels.

The Ethereum Rainbow Chart suggests room for growth, with ETH still trading below its "bubble" range of $9,000-$10,000. This mirrors 2021 patterns when ETH rallied from $1,400 to $4,954 after similar skepticism.

Ethereum Privacy Roadmap 2025: Powerful Vision for End-to-End Protection

The Ethereum Foundation's Privacy & Scaling Explorations team has rebranded as Privacy Stewards of Ethereum (PSE), signaling a strategic shift from experimental cryptography to addressing concrete privacy challenges. A new roadmap, unveiled on September 12 by Sam Richards of the foundation's privacy division, outlines Ethereum's long-term vision for end-to-end protection across its ecosystem.

Vitalik Buterin and key community groups contributed to the framework, which prioritizes three core areas: private writes, private reads, and private proving. Richards emphasized that robust privacy protections are essential for Ethereum to fulfill its role as a global settlement layer without devolving into a surveillance platform.

The rebranding reflects Ethereum's commitment to embedding privacy at its core—a necessary evolution for maintaining digital freedom while scaling the network. This development marks a significant step in aligning Ethereum's infrastructure with its foundational principles of decentralization and user sovereignty.

Crypto Weekly Roundup: Institutional Moves and Regulatory Developments

Nasdaq's $50 million investment in Gemini's upcoming IPO underscores traditional finance's growing embrace of crypto markets. The move signals confidence in digital asset infrastructure as institutional players increasingly bridge legacy systems with blockchain technology.

Tether's planned launch of a US-regulated stablecoin reflects mounting demand for compliant dollar-pegged tokens. Meanwhile, BlackRock's exploration of tokenized ETFs suggests asset managers are preparing for blockchain-based financial products at scale.

BitMine Immersion Technologies bolstered its corporate treasury with 46,255 ETH ($201 million), demonstrating continued institutional accumulation of Ethereum. The transaction, tracked by Onchain Lens, highlights ETH's position as a strategic reserve asset.

Regulatory developments remain a focal point, with India maintaining cautious crypto policies and the SEC scheduling an October 17 roundtable on financial surveillance. These moves occur as Paxos advances its USDH stablecoin proposal, intensifying competition in the regulated stablecoin sector.

Ethereum Targets $5,200 as Bullish Momentum Builds

Ethereum's price trajectory shows remarkable strength, with technical indicators pointing to a potential surge toward $5,200 by September 21, 2025. The MACD histogram at 20.69 underscores robust bullish momentum, while the cryptocurrency currently trades at $4,671.48—hovering near its 52-week high of $4,832.

Analyst consensus reinforces this optimism, with Changelly projecting a $5,202.84 target based on technical and sentiment metrics. CoinCodex and CryptoPredictions.com offer slightly more conservative estimates, yet the overarching narrative remains decidedly bullish. Ethereum's ability to test and potentially breach the $5,000 threshold appears increasingly probable given current market dynamics.

Ethereum Reclaims $4.7K as Traders Eye $10K on Rainbow Chart

Ethereum's price surge past $4,700 signals growing bullish momentum, with traders now targeting five-digit valuations. The rally is fueled by institutional demand, technical upgrades, and macroeconomic tailwinds. Market analysts highlight the stark contrast to 2021, when Ethereum's $1,400 peak was prematurely called—only for it to nearly triple by year-end.

Trader Merlijn The Trader notes the market's evolving psychology: skepticism at $1,500 turned to disbelief at $4,000, yet the chart now "screams five digits." Blockchaincenter.net's Rainbow Chart reinforces this outlook, placing ETH far below its historical "bubble" zone of $9K-$10K. Cas Abbé observes parallels to 2021's underestimation, when ETH defied expectations to hit $4,881.

Institutional flows and ETF speculation add rocket fuel to the rally. Wall Street's involvement—once unthinkable for crypto—now provides structural support absent in previous cycles. The convergence of technical strength and mainstream adoption creates a fundamentally different bull run.

Ethereum Could Reach $6,800 by Year-End as Institutional Interest Surges

Ethereum (ETH) is poised for a potential breakout, with analysts projecting a year-end target of $6,800 as institutional demand accelerates. Trading in the mid-$4,000 range, ETH's momentum is fueled by record open interest in CME futures contracts—a clear signal of growing professional investor confidence.

The Chicago Mercantile Exchange's derivatives market reveals a structural shift in participation. Unlike the retail-dominated activity of 2021-2022, current data shows institutions accumulating both short and medium-term positions. This contrasts sharply with the bear market exodus of 2022, when long-term contracts evaporated during price declines.

Market structure tells the story: the 2023-2024 recovery established a foundation of steady 3-6 month contract growth. Now, hedge funds and proprietary trading firms appear to be building strategic positions rather than speculative bets—a maturation mirroring Bitcoin's institutional adoption trajectory.

Ethereum Eyes $4,880 After $333 Million BlackRock and Fidelity Investment

Ethereum's price surged past $4,700 following a combined $333 million investment from institutional giants BlackRock and Fidelity. The move signals growing confidence among traditional finance players in the second-largest cryptocurrency by market cap.

Analysts now watch the $4,880 resistance level, with a potential breakout paving the way for new all-time highs. Trading volume spiked to $67 billion as ETH gained 3.41% in 24 hours, reflecting strong bullish momentum.

The institutional endorsement comes as crypto markets show renewed strength. "When firms like BlackRock move, the market notices," observed one trader, noting similar patterns during Bitcoin's institutional adoption phase.

Ethereum Price Prediction Points Higher Yet Market Consensus Suggests Rollblock Offers A Sharper ROI

Ethereum's price trajectory remains bullish, bolstered by regulatory clarity and impending network upgrades. The U.S. SEC's confirmation that ETH is not a security has reinvigorated institutional and retail interest, pushing its price to $4,558—a 3.16% daily gain. Technical analysts anticipate a breakout above $4,800, potentially retesting all-time highs near $4,956.

Meanwhile, Rollblock emerges as a disruptive force, capturing investor attention with its presale surge of over $11.7 million and 500% returns for early backers. Market sentiment increasingly favors Rollblock's short-term upside, with projections of 30x growth by 2026 overshadowing Ethereum's steadier institutional appeal.

The upcoming Fusaka upgrade, slated for November, promises enhanced scalability and security for Ethereum—a critical step toward mass adoption. Yet the narrative bifurcates: Ethereum consolidates as a blue-chip asset while Rollblock embodies the high-risk, high-reward dynamism of crypto's frontier markets.

How High Will ETH Price Go?

Based on current technical indicators and market fundamentals, ETH appears positioned for continued upward movement. The convergence of institutional investment through ETFs, positive developer momentum with Ethereum's 2025 privacy roadmap, and technical breakout patterns suggest several potential price targets:

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1-2 months) | $4,880 - $5,200 | Bollinger Band breakout, institutional inflows |

| Medium-term (3-6 months) | $6,800 | ETF momentum, institutional adoption |

| Long-term (12+ months) | $10,000 | Network upgrades, broader crypto adoption |

BTCC financial analyst Olivia emphasizes that 'while the $10,000 target captures attention, traders should focus on the progressive resistance levels at $4,880 and $5,200 as more immediate, achievable milestones.'